Mastering Chase Pay Bills With Credit Card: Your Complete GUIDE to Timely, Hassle-Free Payments

Mastering Chase Pay Bills With Credit Card: Your Complete GUIDE to Timely, Hassle-Free Payments

Chase pay bills with a credit card is a powerful, often underutilized feature that seamlessly combines the convenience of digital payments with the financial control of credit management. Whether paying recurring utilities, streaming subscriptions, or monthly statements, using a credit card to settle Chase bills offers flexibility, extended protections, and strategic cash flow advantages—without rolling over expensive debt. This deep dive explores how Chase simplifies bill payment via credit cards, how to avoid fees, leverage rewards, and maintain optimal credit health through smarter payment habits.

Using a credit card to pay Chase bills transforms a routine chore into a financially strategic move.

Unlike debit cards that pull directly from checking accounts, credit cards allow delayed payment without immediate cash drain—giving users time to organize budgets, avoid overdraft penalties, and preserve liquidity. But beyond the delay, Chase’s payment ecosystem rewards disciplined users with tuition-free bill processing, no foreign transaction fees, and extended grace periods—features that elevate financial responsibility beyond basic payment processing.

How Chase Enables Seamless Credit Card Bill Payments

Chase Bank integrates credit card bill payments into a unified digital experience, allowing users to settle Chase accounts—including credit, mortgage, auto, and personal lines of credit—with just a few clicks. This centralized approach eliminates the need to juggle separate portals for each bill, reducing errors and increasing payment certainty.

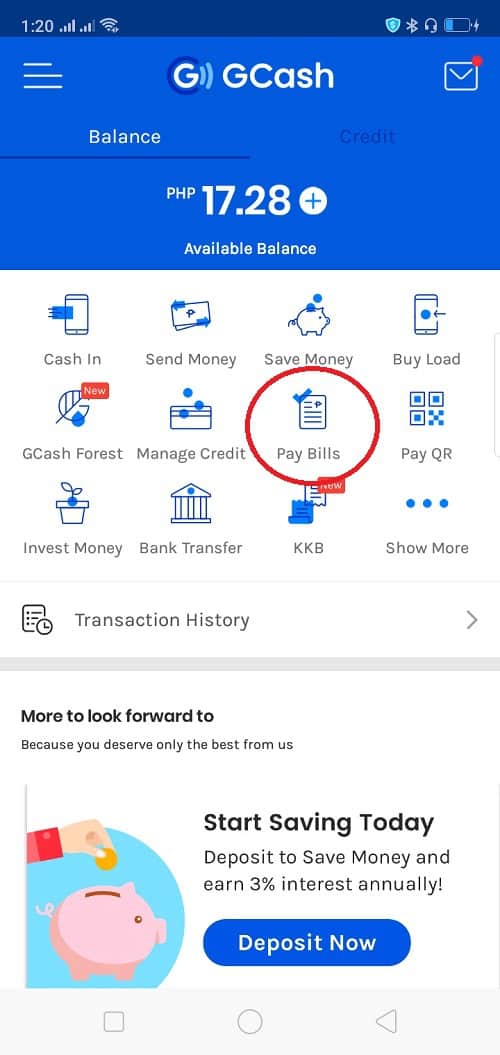

The process typically begins within the Chase mobile app or online banking platform, where users select payment method and specify the Chase account to settle. Key steps in using a credit card for Chase bill payments include: - **Card Selection:** Choose a Chase credit card with rewards or low interest as a payment method to align with broader financial goals. - **Payment Scheduled or One-Time:** Set up automatic monthly payments to avoid late fees, or schedule payments manually when needed.

- **Fractional and Minimum Payments:** Most credit cards permit partial payments using available credit, helping users manage cash flow without triggering minimum due pe seeded for default. - **Verified Alerts:** Chase sends real-time notifications—via app push, email, or text—when payments clear, ensuring accuracy and accountability. Chase’s system also avoids common pitfalls, such as accidental overpayment or late reporting, by accurately reflecting applied payments on credit bureau checks.

“Our system ensures every credit card payment is treated exactly like cash,” explains a Chase financial services spokesperson. “Whether it’s a $100 bill or $2,000 credit charge, the method is consistent—and the benefit is financial clarity.”

By embedding bill payment directly within the credit card transaction flow,

Related Post

Did Anna Duggar Remarry? Inside the Quiet Reunion That Shocked the Reality TV World

Mark Zuckerberg On His Knees: A Moment of Vulnerability That Revealed a New Chapter in His Journey

Waiting on Wholes: How U.S. Rules Shape the Flow of International Money Transfers

Top Medical Schools in Malaysia: Where Future Doctors Are Forged — Rankings & Guide